FAO reports add to agflation worries

I have been following with a rising concern the news about rising food prices. Two recent reports from FAO (www.fao.org) show that despite relatively high crops prices of foodstuffs remain very high (with the exception of sugar). Reports state that volatility of prices has been very high and very persistent, and that there is a growing codependence between the markets. While the forecasts for crops in 2008 remain optimistic, extremely low inventories in many countries and rising freight costs do not bode well for next year outlook. Rising demand from emerging markets and biofuel-related demand is a long-term structural factor. Natural disasters as reported by EM-DAT (www.em-dat.net) are also rising sharply (owing partly to global warming), which indicates that supply disruptions may hit world foodstuffs supply more often that in the past. High food prices will certainly lead to more output in the medium term, but it seems increasingly likely that food inflation may be a more lasting phenomenon that in the past. This may lead to a global “cappuccino effect”, which means that perceived inflation may rise even faster. Food products are bought on daily basis, so even when core inflation remains low, people will perceive rising food inflation as a acceleration of the general inflation, which may lead to higher wage pressures. Global economy can adjust much faster than three decades ago, with agricultural productivity in many emerging markets still at very low levels. But it will probably take few years before proper adjustment takes place. We may still be lucky, weather may be supportive and global supply will rise faster than expected and meet growing demand. But if we are not lucky, then the coming few years may become known as “food price shock” era. Unlike with the oil price shocks thirty years ago, when demand fell rapidly in response to skyrocketing prices of oil, in the case of food price shock demand adjustment is not possible, the only cure is to increase supply and increase world trade in foodstuffs. That is why liberalization of food markets in developed countries in a must, which is not understood by politicians in developed world, who care only about being reelected for next term, and local farming lobbies are usually very strong. With low likelihood of proper policy responses agflation is looming on the horizon.

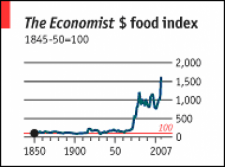

There is also a large editorial in The Economist about agflation risks. Economist computes food prices since 1845, take a look at the recent rise, which is unlikely to be reversed any time soon.