Net migration

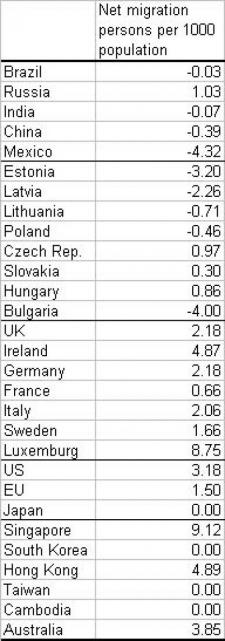

There are several voluminous reports on migration, you can review some of them by clicking on tag migration in my public resources or on my blog main page. But sometimes it is refreshing to take a look at simple table to see a number of interesting trends. I went to the CIA World factbook and downloaded CIA estimates of net migration rates in 2006 (number of people per 1000 population entering the country minus the number of people leaving the country). The table with selected countries is below:

</p>

</a>

Bearing in mind quality of the data (illegal migration, grey economy, registration systems deficiencies) several trends stand out:

- There is a very strong outflow from Mexico and inflow to the US. I do recall articles that some pizza outlets in the US started to accept Mexican peso as legal tender. Data does confirm that imigration supports labor force growth in the US.

- There are no strong net migration flows in BRIC countries, although 0.4% of 1.3 bn is a large absolute number in the case of China.

- Small Asian NIEs enjoy incredibly large inflow rates, and indeed Singapore in its 2015 intelligent nation vision plans to use expacts brain potential for the good of the country (www.in2015.sg)

- EU as a whole experiences net inflow of migrants, but the pace is less than half of that ejoyed by the US. Some new EU members states experience large outflows (Bulgaria, Estonia, Latvia) while others record moderate net inflows. I find it hard to reconcile the recent lament of Polish enterprises about problems to find workers with data showing only moderate net outflow (either data is flawed or lament is exagerated or labor market mismatch in Poland is much greater than elsewhere, which I find hard to believe).

- Old EU member states benefit immensely from EU expansion, in many states net migration flows exceed 0.2%. One can also notice large inflow to Luxemburg, small state making living on investment management, indeed damand for such services rose rapidly in recent years. These inflows do support the Fed Yellen “new view” hypothesis that modern Phillips curves become flatter, ie. inflation appears to be less sensitive to unemployment changes;

- I am sure that some of recent positive trends seen in the eurozone are due to migration (of labor to rich countries and capital from rich to poor neighbors). Also labor arbitrage (a threat of potential job dislocation) is playing an important role.

My final comment to these developments is a picture. It is from the cover of the World Bank report on global migrations. I call this picture “any street in 2030″. Are we ready for this change? Are our politicians ready to accept this and draft laws which will help migrants co contribute to global prosperity, rather than fight the inevitable?