Change management – macro scale

Those of you who managed large institution know that change management is daily life. External environment changes rapidly and institution needs to adjust, re-optimize resources, re-think its vision and strategic goals. I see the same happening on the macro scale, but we are talking global economy here and the management team is scattered around the globe with no clear, commonly shared vision.

Let me give examples of news that have been coming recently:

- China creates new giant asset management company, and announces that it does not want foreign exchnage reserves (above 1.1 trillion dollars equivalent in March) to grow further. Quote: “In an exclusive interview with Emerging Markets, Zhou Xiaochuan said that the new agency could incorporate structural elements from Singapore’s Temasek Holdings and Government Investment Corporation, the Korean Investment Corporation, Norway’s central bank, the Kuwait Investment Authority and the Saudi Arabian Monetary Authority, among other state investment agencies.” … “Zhou would not say how much money will be allocated to the “experimental” agency but noted that the government will “cut a small piece of our reserves for the new management agency”. Officials and local press reports have suggested an amount of up to $300 billion.” … “Zhou stressed that China will also end its practice of stockpiling foreign exchange reserves. “We do not intend to go further and accumulate reserves,” he said. “Many people say that foreign exchange reserves in China are [already] large enough.””

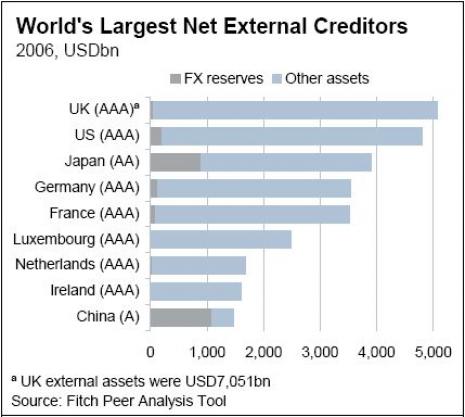

- And by the way, Fitch estimated that China external assets were 1.55tr dollars, see chart below.

- Stock markets around the globe fell off the cliff, and then recovered nicely, leaving many investros pondering whether it was a long overdue correction or something more serious.

- Yen carry trade was analyzed by dozens investment banks and hedge funds, some say it will last, some predict big unravelling and recall one day 15% yen appreciation few years back

- European Union at fifty tries to revive itself, with German Presidency pushing hard to get the constitution process going on again. Some investment banks predict rosy 2007-2008 period, some economists notice that German growth model based on capital intensive production and exports has its drawbacks.

- China announces its plans to take over world automotive industry, and soon after aircraft industry. Few people seem scared today, saying it is long term and if someone should be worried it should be our kids, or maybe even their kids. Next few years will prove that in XXI century the death of time and death of distance has a very practical meaning.

- We focus on bad African countries, those with hyperinflation, with tribes chopping off heads of those from other tribes. But there are very good things going on in Africa, and this is happening with large presence of Chinese diplomacy and funding, and with little or no European presence.

- US housing market heads south and most people expect that this trip will continue for some time, see recent PIMCO analysis, but investors are divided whether it will lead to broader wekaness or will be contained in construction sector. Recent RBS reserves management survey shows that polled central banks are more pessimistic than consensus, and while they were worried about rising US rates a year ago, now the key worry is slowdown or even a possible recession.

- Global imbalances have not been forgotten, US international investment position is getting more red with every month passing

All that is happening while the global economy still enjoys robust growth, after five years of continued strong global growth. Has globalization changed the world so much that business cycles became rare species. Or, possibly the average length of the cycle will be longer, if this is the case, will it apply to all phases?

I have probably written about 5 percent of issues that I have been thinking lately. These are immense changes, often unprecedented. So we do not know what lies ahead, those with XX-century crystal balls and black cats are helpless as well. The only sensible apporach is to prepare for change, with big C, and resort to change management when things begin to happen. And they are happening already, to see this you need to put your XXI century glasses on. I do not know what scenario will materialize in the next few years. I know that it will happen much faster then we predict and the scale will be much bigger, and I mean the shift of power from US/Europe to Asia. I also think economists who do only macro work get the story wrong. Global optimization of business processes and emergence of global labor and knowledge pool made global economy much more resilient than before. So even when things begin to get nasty, we have very strong and efficient shock absorbers, which will help to avoid black scenarios.

And by the way. If US remains in a protectionist mood, I keep wondering in what parts of the world China will make its shopping with reported US300bn allocated to equity investment – listed stocks, private equity, hedge funds mandates etc. (if one takes into account from whom China is learning to invest). Or maybe people who note that central bank money cannot be traced as it gets lost in London, will have an even bigger puzzle to solve in the coming quarters and years. Finally, in the long run real returns in various parts of the globe should be correlated with potential output rates. If you agree then you should also agree that potential output in Asia will grow much faster than elsewhere in the coming years. Interesting …