Pension funds in UK move to bonds and alternative investments

Todays Financial Times brings interesting report prepared by Greenwich Associates about UK pension funds plans to change investment style in the next two years. Funds are planning to reduce exposure to active and passive UK equity (a lot), and international equities (somewhat), and increase domestic/international fixed income, property, corporate credit, private quity and hedge funds (a lot for all asset classes).

Report says that funds are planning to reduce equity exposure to reduce volatility, while still expcted return on equities is 7.5% (highr than 7% expected for hedge funds and property), so it is the expected return per unit of risk, that probably appears too low.

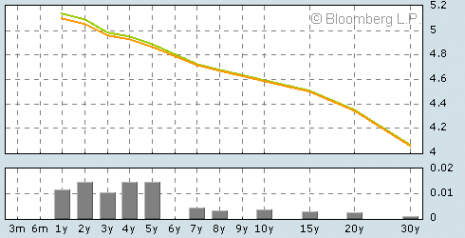

When one takes a look at the UK yield curve (chart below) one may wonder what attracts funds to the yield curve, which is downward sloping and appears to predict recession (inversion).

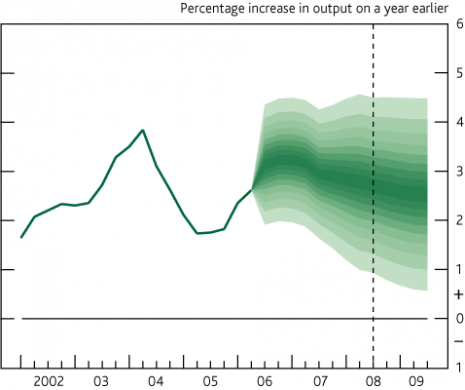

Of course recession is not expected, and actually the GDP fanchart from recent BoE inflation Report points to good growth prospects, see below.

So there are other – structural – factors inverting the yield curve, not recession expectations. These could be related to higher demand for GBP denominated assets coming from institutional investors, see BIS report for example.

One can think about possible consequences. If institutional investors and – as suggested by BIS – central banks diversify to international fixed income and at the same time accept lower liqudity in many less developed markets, than it may result in significant foreign exchange volatility in some markets. Global imbalances, rapid growth of credit derivatives and hedge fund industry, structural demand shifts across asset classes, well, we should brace for a very interesting 2007.

And finally and unfortunately, sharply growing demand for international fixed income does not create good conditions for fiscal reforms, because it is easier to finance fiscal excesses, see Tytell, Wei (2004) paper for example.