Investment banks' recommendations matter

Before becoming a central banker I spent seven years as a chief economist for several international financial institutions covering Poland in the regional context. I know very well what the pressures could be to publish “politically correct” research, and what it takes to put the analyst view forward. I personally experienced two cases, when very high level politicians (from peasant party and from former communist party) demanded that I should be fired at headquarters of our parent bank. They failed and the quality research was kept.

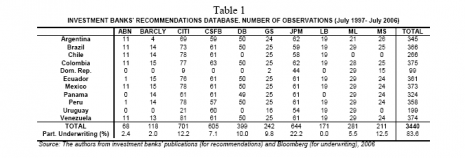

A very interesting analysis on the issue of investment banks recommendations in the context of Latin America debt and equities has been published by Parra, Santiso. In short authors find that investment banks recommendations are biased towards maintaining good client relations (very few sell recommendations when underwriting and for big countries, which are important for capital markets business).

But even more interesting is another result, that recommendations do matter, as they explain why capital flows to bond markets and (to a lesser extent) to equity markets. For central bankers it implies a need to improve coverage of recommendations covering their countries or regions (as now many strategies and regional or basket strategies). And recommendations seem to matter more that some important macro variables. Very interesting paper, definitely worth reading.