IMF World Economic Outlook, key points

IMF baseline scenario points to a very robust growth in 2007 at 4.9 percent, only marginally below 5.1 percent expected this year, both estimates rased by 0.25 percent from April’s WEO. IMF assigns 1/6 probablity to global growth slowing below 3 1/4 next year. With very few exceptions (such as Nouriel Roubini) everybody’s base scenario is still positive, while downside risks continue to mount, with every month of US housing data.

IMF predicts that in baseline scenario US current account deficit will widen to 6.9 percent of GDP in 2007 and that growth of housing prices in US will continue to slow, which will be a drag on US consumption amounting to 0.5 percent of GDP. In the risk scenario, when housing prices fall, it may shave off additional 1 percent of US growth.

The ten million dollar question is whether the risk scenario will materialize. Next few months of data should be very informative, I suggest that you take a look at Robert Shiller (economics professor at Yale) presentation at Chicago Fed conference in MAy 2006, who documents that present housing bubble is unprecedented. We are really on uncharted territory, also in terms of housing arms-length and innovative financing. Any extrapolation from past data or past episodes may prove misleading.

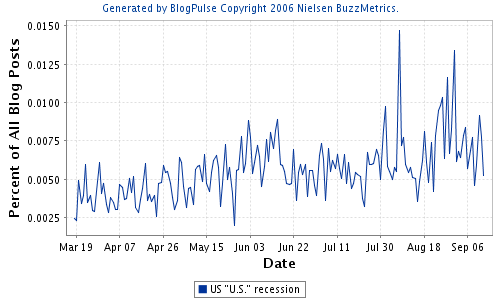

One should not be surprised that officials avoid predicting recessions, as it could affect private sector expectations and contribute to a downturn. Indeed if you take a look at the chart below you will see that blogospere has been busy recently talking about U.S. recession (trend from blogpulse on US recession).

Now we turn to IMF WEO :

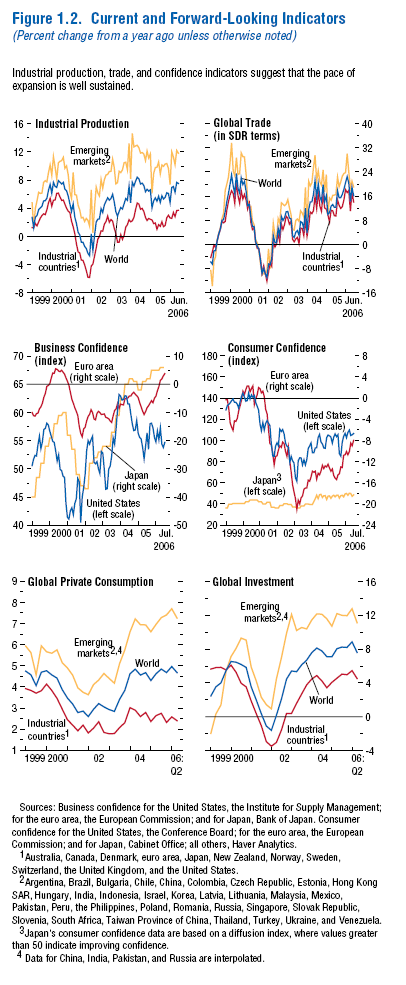

The forecast for global growth has been marked up to 5.1 percent in 2006 and 4.9 percent in 2007, both 1/4 of a percentage point higher than in the April 2006 World Economic Outlook.Growth in the United States is expected to slow from 3.4 percent in 2006 to 2.9 percent in 2007, amid a cooling housing market. Growth in Japan will also ease as the cycle matures. In the euro area, the recovery is projected to sustain its momentum this year, although growth in Germany will be reduced in 2007 by the planned tax increase.

Among emerging markets and developing countries, growth is expected to remain very strong, with the Chinese economy continuing its recent rapid expansion.The balance of risks to the global outlook is slanted to the downside, with IMF staff estimates suggesting a one in six chance that growth could fall to 3 1/4 percent or less in 2007.

The most notable risks are that inflationary pressures could intensify, requiring monetary policy to be tightened more than currently expected; that oil prices could increase further against the background of limited spare capacity and geopolitical uncertainties; and that the U.S. housing market could cool more rapidly than expected, triggering a more abrupt slowdown of the U.S. economy.

The potential for a disorderly unwinding of global imbalances remains a concern. A smooth, market-led unwinding of these imbalances is the most likely outcome, although investors would need to continue increasing the share of U.S. assets in their portfolios for many years to allow this to happen. The depth and sophistication of U.S. financial markets has facilitated the financing of recent large current account deficits. However, there remains some risk of a disorderly adjustment, which could impose heavy costs on the global economy.

[IMF baseline scenario points to a very robust growth in 2007 at 4.9 percent, only marginally below 5.1 percent expected this year, both estimates rased by 0.25 percent from April’s WEO. IMF assigns 1/6 probablity to global growth slowing below 3 1/4 next year. With very few exceptions (such as Nouriel Roubini) everybody’s base scenario is still positive, while downside risks continue to mount, with every month of US housing data.

IMF predicts that in baseline scenario US current account deficit will widen to 6.9 percent of GDP in 2007 and that growth of housing prices in US will continue to slow, which will be a drag on US consumption amounting to 0.5 percent of GDP. In the risk scenario, when housing prices fall, it may shave off additional 1 percent of US growth.

The ten million dollar question is whether the risk scenario will materialize. Next few months of data should be very informative, I suggest that you take a look at Robert Shiller (economics professor at Yale) presentation at Chicago Fed conference in MAy 2006, who documents that present housing bubble is unprecedented. We are really on uncharted territory, also in terms of housing arms-length and innovative financing. Any extrapolation from past data or past episodes may prove misleading.

One should not be surprised that officials avoid predicting recessions, as it could affect private sector expectations and contribute to a downturn. Indeed if you take a look at the chart below you will see that blogospere has been busy recently talking about U.S. recession (trend from blogpulse on US recession).

Now we turn to IMF WEO :

The forecast for global growth has been marked up to 5.1 percent in 2006 and 4.9 percent in 2007, both 1/4 of a percentage point higher than in the April 2006 World Economic Outlook.Growth in the United States is expected to slow from 3.4 percent in 2006 to 2.9 percent in 2007, amid a cooling housing market. Growth in Japan will also ease as the cycle matures. In the euro area, the recovery is projected to sustain its momentum this year, although growth in Germany will be reduced in 2007 by the planned tax increase.

Among emerging markets and developing countries, growth is expected to remain very strong, with the Chinese economy continuing its recent rapid expansion.The balance of risks to the global outlook is slanted to the downside, with IMF staff estimates suggesting a one in six chance that growth could fall to 3 1/4 percent or less in 2007.

The most notable risks are that inflationary pressures could intensify, requiring monetary policy to be tightened more than currently expected; that oil prices could increase further against the background of limited spare capacity and geopolitical uncertainties; and that the U.S. housing market could cool more rapidly than expected, triggering a more abrupt slowdown of the U.S. economy.

The potential for a disorderly unwinding of global imbalances remains a concern. A smooth, market-led unwinding of these imbalances is the most likely outcome, although investors would need to continue increasing the share of U.S. assets in their portfolios for many years to allow this to happen. The depth and sophistication of U.S. financial markets has facilitated the financing of recent large current account deficits. However, there remains some risk of a disorderly adjustment, which could impose heavy costs on the global economy.

](/uploads/imf_weo_sep2006_global_growth.png “IMF_WEO_growth_chart”)

[IMF baseline scenario points to a very robust growth in 2007 at 4.9 percent, only marginally below 5.1 percent expected this year, both estimates rased by 0.25 percent from April’s WEO. IMF assigns 1/6 probablity to global growth slowing below 3 1/4 next year. With very few exceptions (such as Nouriel Roubini) everybody’s base scenario is still positive, while downside risks continue to mount, with every month of US housing data.

IMF predicts that in baseline scenario US current account deficit will widen to 6.9 percent of GDP in 2007 and that growth of housing prices in US will continue to slow, which will be a drag on US consumption amounting to 0.5 percent of GDP. In the risk scenario, when housing prices fall, it may shave off additional 1 percent of US growth.

The ten million dollar question is whether the risk scenario will materialize. Next few months of data should be very informative, I suggest that you take a look at Robert Shiller (economics professor at Yale) presentation at Chicago Fed conference in MAy 2006, who documents that present housing bubble is unprecedented. We are really on uncharted territory, also in terms of housing arms-length and innovative financing. Any extrapolation from past data or past episodes may prove misleading.

One should not be surprised that officials avoid predicting recessions, as it could affect private sector expectations and contribute to a downturn. Indeed if you take a look at the chart below you will see that blogospere has been busy recently talking about U.S. recession (trend from blogpulse on US recession).

Now we turn to IMF WEO :

The forecast for global growth has been marked up to 5.1 percent in 2006 and 4.9 percent in 2007, both 1/4 of a percentage point higher than in the April 2006 World Economic Outlook.Growth in the United States is expected to slow from 3.4 percent in 2006 to 2.9 percent in 2007, amid a cooling housing market. Growth in Japan will also ease as the cycle matures. In the euro area, the recovery is projected to sustain its momentum this year, although growth in Germany will be reduced in 2007 by the planned tax increase.

Among emerging markets and developing countries, growth is expected to remain very strong, with the Chinese economy continuing its recent rapid expansion.The balance of risks to the global outlook is slanted to the downside, with IMF staff estimates suggesting a one in six chance that growth could fall to 3 1/4 percent or less in 2007.

The most notable risks are that inflationary pressures could intensify, requiring monetary policy to be tightened more than currently expected; that oil prices could increase further against the background of limited spare capacity and geopolitical uncertainties; and that the U.S. housing market could cool more rapidly than expected, triggering a more abrupt slowdown of the U.S. economy.

The potential for a disorderly unwinding of global imbalances remains a concern. A smooth, market-led unwinding of these imbalances is the most likely outcome, although investors would need to continue increasing the share of U.S. assets in their portfolios for many years to allow this to happen. The depth and sophistication of U.S. financial markets has facilitated the financing of recent large current account deficits. However, there remains some risk of a disorderly adjustment, which could impose heavy costs on the global economy.

[IMF baseline scenario points to a very robust growth in 2007 at 4.9 percent, only marginally below 5.1 percent expected this year, both estimates rased by 0.25 percent from April’s WEO. IMF assigns 1/6 probablity to global growth slowing below 3 1/4 next year. With very few exceptions (such as Nouriel Roubini) everybody’s base scenario is still positive, while downside risks continue to mount, with every month of US housing data.

IMF predicts that in baseline scenario US current account deficit will widen to 6.9 percent of GDP in 2007 and that growth of housing prices in US will continue to slow, which will be a drag on US consumption amounting to 0.5 percent of GDP. In the risk scenario, when housing prices fall, it may shave off additional 1 percent of US growth.

The ten million dollar question is whether the risk scenario will materialize. Next few months of data should be very informative, I suggest that you take a look at Robert Shiller (economics professor at Yale) presentation at Chicago Fed conference in MAy 2006, who documents that present housing bubble is unprecedented. We are really on uncharted territory, also in terms of housing arms-length and innovative financing. Any extrapolation from past data or past episodes may prove misleading.

One should not be surprised that officials avoid predicting recessions, as it could affect private sector expectations and contribute to a downturn. Indeed if you take a look at the chart below you will see that blogospere has been busy recently talking about U.S. recession (trend from blogpulse on US recession).

Now we turn to IMF WEO :

The forecast for global growth has been marked up to 5.1 percent in 2006 and 4.9 percent in 2007, both 1/4 of a percentage point higher than in the April 2006 World Economic Outlook.Growth in the United States is expected to slow from 3.4 percent in 2006 to 2.9 percent in 2007, amid a cooling housing market. Growth in Japan will also ease as the cycle matures. In the euro area, the recovery is projected to sustain its momentum this year, although growth in Germany will be reduced in 2007 by the planned tax increase.

Among emerging markets and developing countries, growth is expected to remain very strong, with the Chinese economy continuing its recent rapid expansion.The balance of risks to the global outlook is slanted to the downside, with IMF staff estimates suggesting a one in six chance that growth could fall to 3 1/4 percent or less in 2007.

The most notable risks are that inflationary pressures could intensify, requiring monetary policy to be tightened more than currently expected; that oil prices could increase further against the background of limited spare capacity and geopolitical uncertainties; and that the U.S. housing market could cool more rapidly than expected, triggering a more abrupt slowdown of the U.S. economy.

The potential for a disorderly unwinding of global imbalances remains a concern. A smooth, market-led unwinding of these imbalances is the most likely outcome, although investors would need to continue increasing the share of U.S. assets in their portfolios for many years to allow this to happen. The depth and sophistication of U.S. financial markets has facilitated the financing of recent large current account deficits. However, there remains some risk of a disorderly adjustment, which could impose heavy costs on the global economy.

](/uploads/imf_weo_sep2006_global_growth.png “IMF_WEO_growth_chart”)

](/uploads/imf_weo_sep2006_global_growth.png “IMF_WEO_growth_chart”)