IMF-World Bank Spring meetings

I started blogging few months ago. Since then I had written posts sitting in Siem Rep, Cambodia, Cairo, Egypt, few airports, various places in Poland, and now I am writing this one in Washington, where I participated in the IMF/WB Spring meetings. There were many important statements, there is push from G-7 countries to involve IMF more into countries’ exchange rate policy assessements, which is opposed by G-24. The tone is generally optimistic, with many people expecting another two good years, with some downside risks related to US housing market, credit derivatives markets or disorderly unwinding of global imbalances. Everybody around was telling me that decoupling from US slowdown should be expected. For countries like Poland it probably means a continuation of abundant liquidity conditions, capital inflows and currency appreciation. Such period should be used to foster and deepen structural reforms.

I have been walking across the 19th street back and forth to get a better picture of what is happening. World Bank Institute breakfast was focused on reforming donors efficiency in developing countries. Few motives do stand out, donors often pay a 250,000 dollars wage to expat expert that does not bring a sustainable progress to recepient institution, and are unwilling to pay 5,000 dollars a month wage extention to local person to keep her or him in kis current job and prevent from moving abroad. This is counterproductive and often detroys local reform momentum. Second issue is realed to the lack of comon vision and misaligned incentives, those of donors and those of developing countries. The solution to these problems is to rely more on the peer knowledge and not to impose the developed country best practice on developing ones, as it simply may not work.

Across the 19th street there was a very interesting seminar organized by the Banque de France on hedge funds, there is also an excellent publication with contributions from well known central bankers and academics. This collection of papers acknowledges benefits that HFs brought (risk diversification, price discovery, contribution to financial technology development) and seeks the right way to avoid risks related to hedge funds, which account for a large percentage of turnover on many markets (CDOs, equity derivatives).

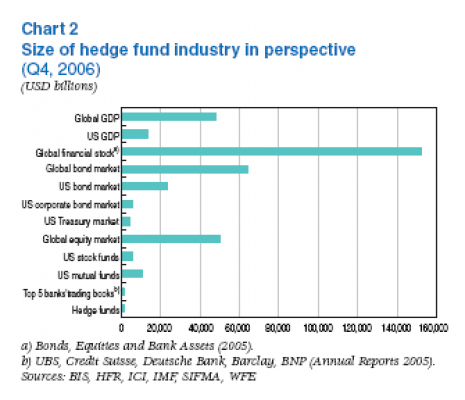

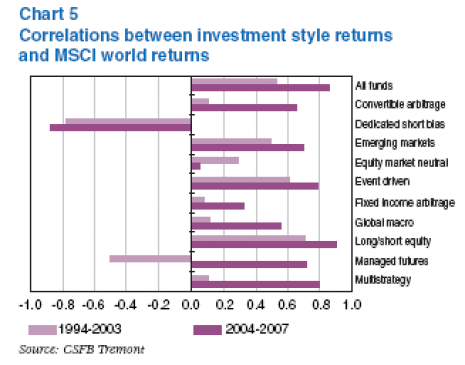

Two interesting points were made by SNB board member Philipp Hildebrand, formerly a hedge fund industry representative. That globally hedge funds are still small players, and that their best are strongly correlated. See charts below. Finally the likely solution will be impose more tranparency on hedge funds, possibly adoption of the code of conduct, reporting of risks (and not reporting of individual trades), close monitoring of margin requirements and collateral quality, and running stress tests.